rhode island income tax rate

Rhode Island Income Tax Calculator 2021. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081.

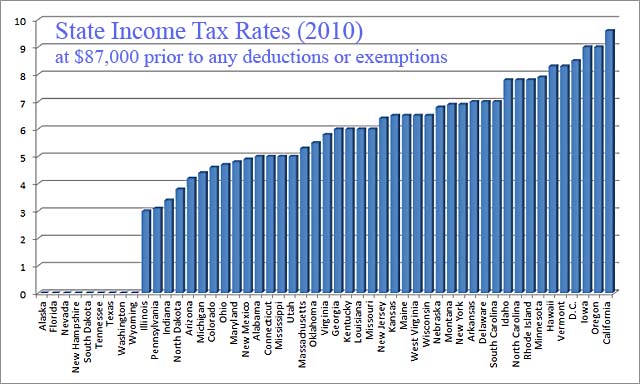

Individual Income Tax Structures In Selected States The Civic Federation

This tool compares the tax brackets for single individuals in each state.

. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Rhode Island also has a 700 percent corporate income tax rate. Any income over 150550 would be.

Rhode Island Tax Brackets for Tax Year 2021. Instead if your taxable. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

Rhode Island Real Property Taxes. Our Rhode Island retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income. Find out how much youll pay in Rhode Island state income taxes given your annual income.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate. The range where your annual. Rhode Island uses a progressive tax system with three different tax brackets ranging from 375-599.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. For the 2022 tax year homeowners 65 and. Your average tax rate is 1758 and your.

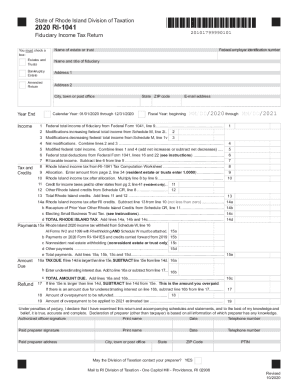

DO NOT use to figure your Rhode Island tax. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. DO NOT use to figure your Rhode Island tax.

Use this tool to compare the state income taxes in Rhode Island and California or any other pair of states. In Rhode Island the median property tax rate is 1571 per 100000 of assessed home value. Customize using your filing status deductions exemptions and more.

Rhode Island has a. More about the Rhode Island Income Tax. Rhode Island based on relative income and earningsRhode Island state.

To calculate the Rhode Island taxable income the statute starts with Federal taxable. More about the New York Income Tax. Outlook for the 2023 Rhode Island income tax rate is to remain unchanged with income tax brackets increasing due to the annual inflation adjustment.

Your average tax rate is 1198 and your. Rhode Island Income Tax Calculator 2021. Residents of Rhode Island are also subject to federal income tax rates and must generally file a federal income tax return by April 17.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income. Each tax bracket corresponds to an income range.

Are you considering moving or earning income in another state. Personal Income Tax RI Division of Taxation. In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by the.

If you make 140000 a year living in the region of Rhode Island USA you will be taxed 32198. Detailed Rhode Island state income tax rates and brackets are. The tax rates are broken down into groups called tax brackets.

As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Income tax brackets are required state taxes in.

Fiduciary Income Tax Forms Rhode Island Division Of Taxation Fill Out And Sign Printable Pdf Template Signnow

How Do State And Local Sales Taxes Work Tax Policy Center

Will Mississippi Join The No Income Tax Club International Liberty

How To Form An Llc In Rhode Island Llc Filing Ri Swyft Filings

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Ri 1040xamended Rhode Island Individual Income Tax Return 2010

Minnesota Should Reduce Its Individual Income Tax Rates American Experiment

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Minnesota Should Reduce Its Individual Income Tax Rates American Experiment

Rhode Island State Tax Guide Kiplinger

State Income Tax Rates Highest Lowest 2021 Changes

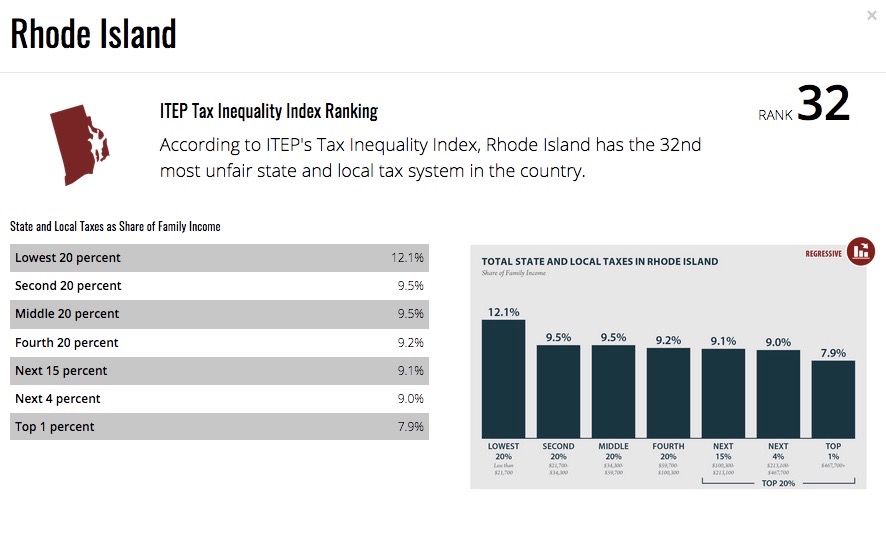

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

Report Shows States Revenue Sources The Pew Charitable Trusts